Compare Individual & Family Plan options

Get the best CHPW Individual & Family Cascade Select Plan for you and your family. Here you will find resources to help you choose between Cascade Select Bronze, Silver, and Gold plans. Prefer to talk to someone? Contact us directly and we will guide you through your options.

Call us at 1-833-993-0181 Meet us

On this page |

Questions to ask when choosing a plan

Health insurance protects you from big medical bills and helps you pay for things like doctor’s visits, prescriptions, urgent care, and more. When choosing a plan, it’s important to consider your health needs and your budget.

These questions are a good place to start:

What is my health like? How often do I go to the doctor?

Preventive care, doctors’ visits, checkups, and support managing blood pressure and diabetes, are covered right away with all your options. If you expect to go to the doctor often, a plan with a higher monthly premium, but lower cost at the time of service, might be for you.

What are my health needs? Now and within the next year?

Emergencies happen. But, if you have medical needs you know about, or a condition that could create an emergency if not managed, it’s important to consider the cost of getting care.

Things like:

- An upcoming surgery

- A chronic condition that requires lab tests, regular doctors’ visits, and prescriptions – like diabetes

- Prescription drugs you take regularly

You might also consider how likely you are to have injuries or accidents.

For example, if you:

- Play contact sports, like soccer

- Have hobbies like mountain biking, or skiing

- Work a job that is very physical, or injuries are more common

And anything else that might increase the amount of care you might need.

When you need more care, you may consider a plan that pays for a bigger part of your medical services at the time of care, like a Gold plan.

How many prescription drugs do I take regularly? Will my current prescriptions be covered?

All plans cover prescription drugs, but your share of the cost for prescription drugs depends on your plan and the type of drug. A Bronze plan would pay the least toward prescriptions, a Gold plan would pay the most. Learn more.

What types of savings or financial help are available for me?

Financial help is available based on income, family size, plan type, and where someone lives. Savings could help lower your monthly costs (premium) and help with your total out-of-pocket costs (cost-share reductions).

There are three main types of financial assistance:

- Advanced Premium Tax Credits – Federal subsidies that lower your monthly premium.

- Cost-Sharing Reductions – Federal subsidies that lower your out-of-pocket costs. Available on Silver plan only.

- Cascade Care Savings – State subsidies that lower your monthly premium. Available on Gold and Silver plans only.

Cascade Care Savings from the state is available to anyone who qualifies based on income, regardless of immigration status.

Federal help, like premium tax credits and cost-share reductions are only available to U.S. citizens or lawfully present immigrants who meet qualifications. Learn more

American Indians and Alaska Natives (AI/AN) may be eligible for savings with any metal level, that could reduce some or all costs for those who qualify. Learn more.

What do I spend on health care today? Will my budget change in the next year?

Making sure you sign up for a health plan that fits your budget is important. It starts with knowing how much you will pay monthly, what’s covered by the plan, and understanding deductibles, coinsurance, and copayments. Learn more

Will my doctor be in the plan’s care network?

CHPW’s network is made up of 1,470 primary care providers and over 9,700 medical specialists. With CHPW Individual & Family Plans, you choose an in-network Primary Care Provider (PCP) CHC clinic to get your medical care. Check to see if your doctor is in-network or learn more about choosing a primary care provider with CHPW.

Am I eligible for other coverage such as Apple Health (Medicaid)?

When you apply for a plan on Healthplanfinder and provide your income information, you will be directed to an Apple Health plan, if you do qualify. We can also help you check.

If you don’t qualify for Apple Health, you may still qualify for savings on a low-cost Individual & Family plan. To get help, contact our team at 1-833-993-0181 (TTY:711) 8:00 a.m. and 5:00 p.m., Monday through Friday.

Is a health insurance plan offered through my job?

Your total cost of health care could be less with the plan your employer offers. Or you may find an Individual & Family plan is better for you.

If your employer-provided plan costs more than 9.5% of your salary, you may be eligible for an Individual and Family plan.

Consider:

- Does your employer pay some or all of the monthly premium?

- Does the plan offer care and services before you meet your deductible?

- Will you use all the benefits included in your employer plan?

Note: A job change counts as an event that would let you sign up for (or change) health plans, outside of the scheduled time each year everyone starts or switches plans (open enrollment).

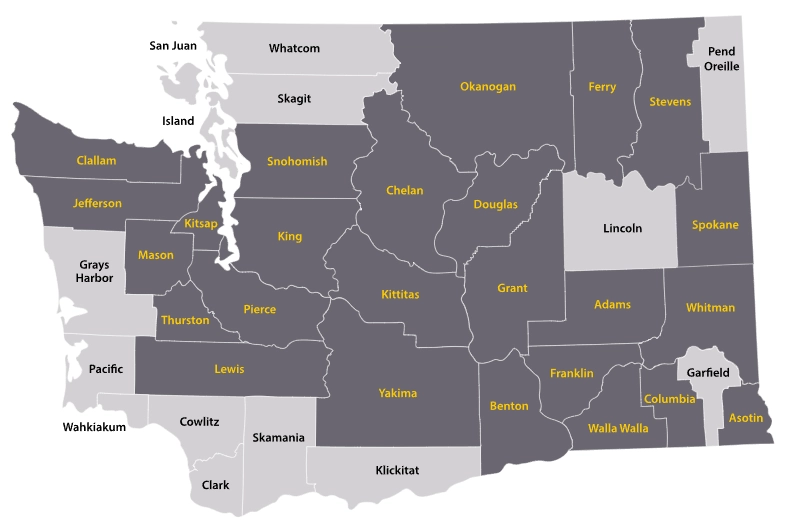

See if CHPW Individual & Family Plans are available in your county

Use our map to find out where CHPW plans are offered. Here you can also get to know a local plan specialist in your community.

Compare your plan options

CHPW Individual & Family Plans come in three metal levels: Bronze, Silver, and Gold.

They all cover the same health services and offer the same quality care. The main difference is how much you pay for care and how much your insurance pays. Here are a few key details:

Bronze plans $

Great if you rarely go to the doctor and want a low-cost way to protect yourself in case of a serious illness or injury.

- Lowest monthly payment (premium)

- You pay the most when you need care

- Cascade Care Savings is not offered with Bronze plans

Silver plans $$

Great if you visit the doctor regularly. Silver plans pay for more care than Bronze plans.

- Moderate monthly payment (premium)

- Moderate cost when you need care

- Cascade Care Savings is available to lower the monthly cost if you qualify

- Additional savings called Cost-Share Reductions may be available if you qualify

Gold plans $$$

Great if you go to the doctor frequently throughout the year. Those who use the most care, get the most value out of a Gold plan.

- Highest monthly payment (premium)

- Lowest cost at the time of care

- Cascade Care Savings is available to lower the monthly cost if you qualify

Learn more by comparing the deductibles (how much you pay before insurance starts to pay) and what you pay at the time of care (co-pay).

Summary of Benefits: Compare plan benefits and costs

Take a look at a summary of things each plan has to offer.

Includes:

- The care and health services you get

- The percentage you pay when you get care

- How much each plan pays for your services (covers)

Not sure what premiums, deductibles, or copayments are? Peek at this article for a quick overview.

Ready to join our community?

We are here to help you find the best plan for you. Find out how to apply for a CHPW Individual & Family plan, schedule a meeting with a plan specialist, or call us.

Still need help? Our Customer Service team is here for you.

Call us at 1-833-993-0181 (TTY:711) 8:00 a.m. and 5:00 p.m., Monday through Friday